Spread dan syarat terbaik kami

Tentang platform

Tentang platform

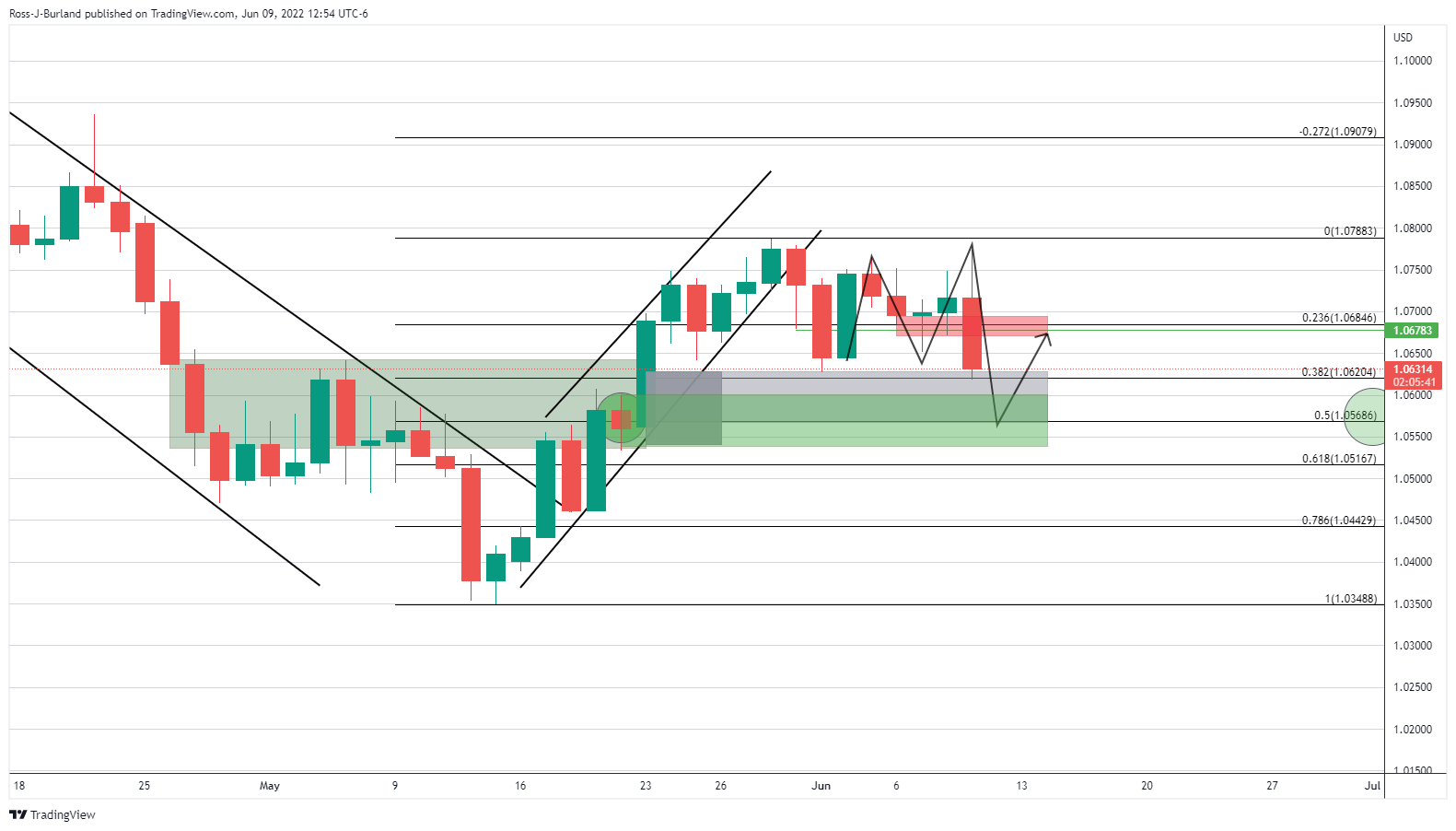

As per the pre-ECB analysis from Thursday's Asian morning session, EUR/USD Price Analysis: Bears are stalling bullish advances at key resistance, 50% mean reversion eyed, the euro has come under immense selling pressure and moved in on a critical area of price imbalance which leaves the 50% target vulnerable.

The W-formation was spotted on the weekly chart, a reversion pattern that leaves the 50% mean reversion target vulnerable for the time ahead.

The price extended the correction towards the target as illustrated above.

From a daily perspective, there is an M-formation being formed from Thursday's price action. However, while this too is a reversion pattern, there is a price imbalance between June 1's low and May 20 lows of 1.0532 that the bears are embarking on. Mitigation of this price area, around 80 pips to the downside, could play out over the course of the next sessions if bears stay in control.

From an hourly perspective, the price is testing the mitigation area, but the drop could be ripe for a meanwhile correction: