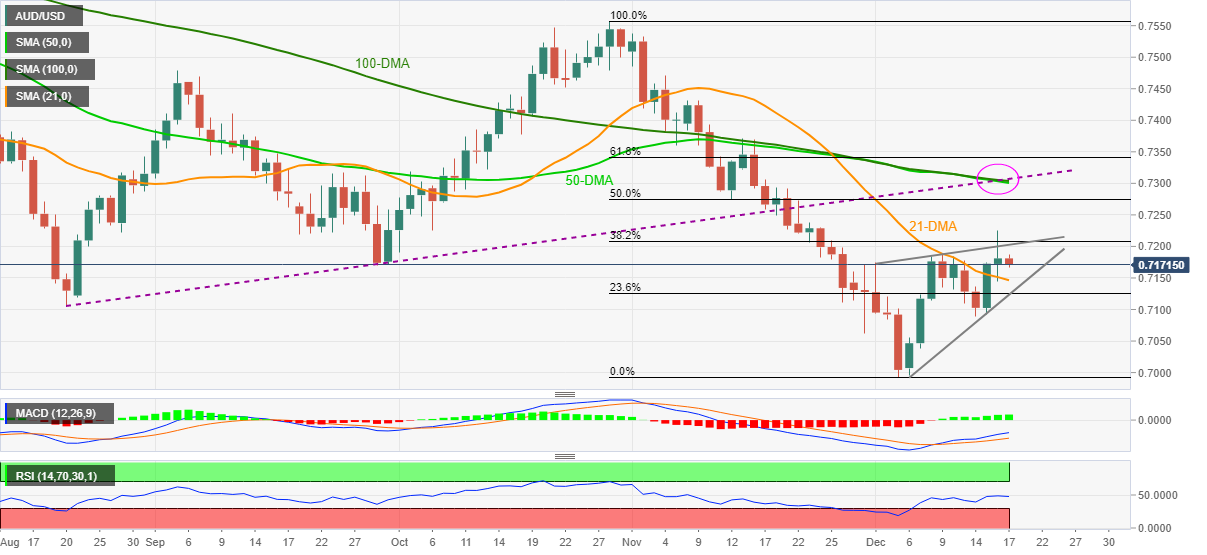

AUD/USD Price Analysis: Failure to stay beyond 0.7200 directs sellers towards 21-DMA

- AUD/USD sellers attack intraday low, extends previous day’s pullback from monthly resistance.

- Steady RSI, bullish MACD signals keep buyers hopeful until breaking 21-DMA, 0.7125 will be the key afterward.

- Multiple DMAs, previous support line highlight 0.7300-05 as tough nut to crack for buyers.

AUD/USD retreats to intraday low around 0.7170, down 0.15% on a day during early Friday.

The Aussie pair refreshed monthly top the previous day but failed to provide a daily closing beyond the one-week-old resistance line, which in turn triggered the quote’s latest pullback.

However, bullish MACD signals and firmer RSI line favor buyers until witnessing a downside break of 21-DMA level of 0.7145.

Even if the quote drops back below 0.7145, a convergence of the support line of short-term rising wedge bearish formation and 23.6% Fibonacci retracement (Fibo.) of October-December downside, around 0.7125, becomes the key to follow.

Meanwhile, a successful run-up beyond the 0.7200 mark will propel the quote towards the 0.7300 threshold comprising 100-DMA, 50-DMA and previous support line from August.

It should be noted, however, that 61.8% Fibo. level near 0.7340 and the mid-November swing high near 0.7370 will challenge the pair’s upside past 0.7300.

AUD/USD: Daily chart

Trend: Further weakness expected