GBP/USD holds around pre-Fed levels on as expected Fed statement

- GBP/USD holds its ground following the Fed taper announcement.

- Fed statement inline with expectations, a slight tweak to the transitory language supports greenback.

- All eyes now turn to Powell's presser, the Fed Dec meeting and US data as well as the BoE.

GBP/USD was trading around 1.3670 on the release of the Federal Reserve's statement where it appears that the board members are less certain that inflation will be transitory. Nevertheless, the price made a fresh high during the knee-jerk reaction to the statement and wider spreads. The range, so far today, has been between 1.3607 and 1.3686.

Fed statement takeaways

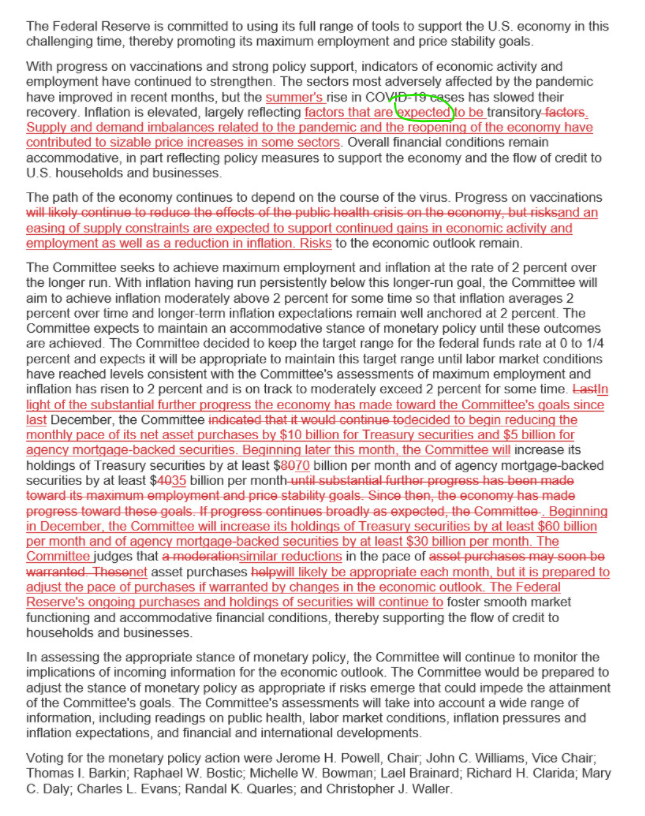

The Federal Reserve will begin dialling back the quantitative easing that it has provided since the coronavirus pandemic erupted last year in response to high inflation that now looks likely to persist longer than it did just a few months ago. In the statement, it maintained the transitory language but changed the wording, from ''reflecting transitory factors'' to, ''factors that are expected to be transitory'':

- Tapering starting November, with monthly reductions of $15 bln.

- Prepared to adjust taper pace ‘as warranted’.

- Interest rate decision actual: 0.25% vs 0.25% previous; est 0.25%.

Next up, Fed's Powell presser, watch live

The Fed's chair Jerome Powell will now likely emphasize how tapering will lead to flexibility in responding if the economy evolves in a way that deviates significantly from expectations. He should be pressed on the change in the statement with regards to transitory language as well.

Given there is no set detail as for the path of tapering beyond December, he will likely be questioned as to what the expected lines are going to be from there onwards and how fast he expects the taper to be until the rate hike lift-off.

BoE and US data firmly in focus

The market will now be left data watching with respect to the US dollar. At the end of the week, Nonfarm Payrolls will be critical and given today's ADP report, the bias is tirled to the bullish side.

This week's Bank of England policy decision is close to a coin toss, according to analysis at TD Securities. However, regardless of the outcome, the analysts at TDS expect the BoE to hike rates by 15bps at one of the two remaining 2021 meetings. ''This meeting is marginally more suitable, given recent messaging and the accompanying MPR, projections, and press conference. The MPC's tone will likely imply a subsequent hike, but probably not until February.''