Back

18 Oct 2021

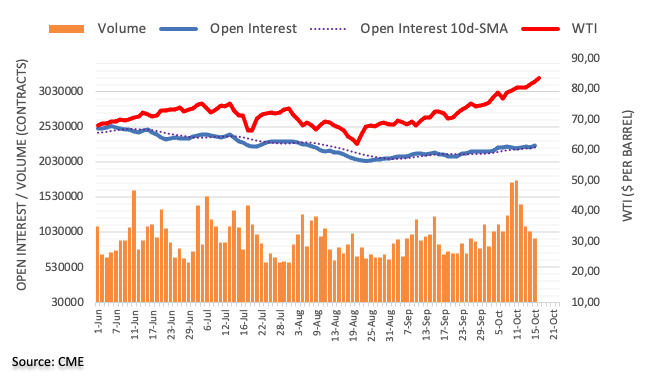

Crude Oil Futures: Further gains on the cards

CME Group’s advanced figures for crude oil futures markets noted open interest resumed the upside and increased by around 20.6K contracts on Friday. On the other hand, volume shrank for the fourth consecutive session, this time by around 102.5K contracts.

WTI: Rally looks unabated, but a correction looks likely

There seems to be no respite for the upside momentum in prices of the WTI. Friday’s uptick was in tandem with rising open interest allowing for the continuation of the move in the very near term at least. However, the current overbought condition of the commodity hints at the likelihood of a corrective decline in the not-so-distant future. On the upside, the $85.00 mark per barrel already emerges on the horizon.