EUR/USD Price Analysis: Refreshes two-month high, bulls keep reins above 1.2100

- EUR/USD stays bid near the multi-day high, prints three-day winning streak.

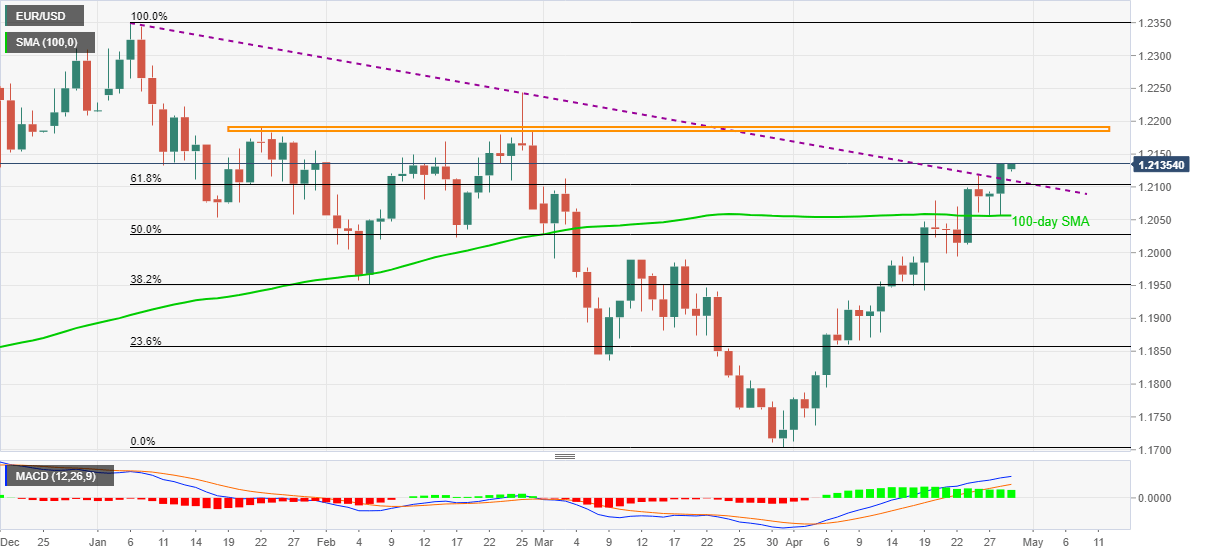

- Clear break of yearly resistance line, 61.8% Fibonacci retracement back the bulls.

- Three-month-old horizontal area lure buyers, 100-day SMA adds to the downside filters.

EUR/USD rises to a fresh high since late February while taking the bids near 1.2135, up 0.07% intraday, during Thursday’s Asian session. In doing so, the currency major pair print gains for the third consecutive day after bouncing off 100-day SMA earlier in the week.

Not only the sustained trading beyond 100-day SMA but the quote’s successful upside break of a descending resistance line from January 06, now support, as well as 61.8% Fibonacci retracement of January-March declines, also back the EUR/USD bulls.

As a result, the pair’s run-up towards 1.2185-90 horizontal area comprising multiple highs marked since February 26 can’t be ruled out. However, 1.2210 and February’s top near 1.2245 will test any further upside past-1.2190.

Meanwhile, the recently broken trend line and 61.8% Fibonacci retracement, respectively around 1.2110 and 1.2100, restrict the EUR/USD pair’s short-term downside ahead of the 100-day SMA level of 1.2056.

If at all the EUR/USD bears take charge below 1.2056, 50% Fibonacci retracement level and highs marked during March 11-18, near 1.2030 and 1.1990 in that order, will challenge the quote’s further weakness.

EUR/USD daily chart

Trend: Bullish