EUR/USD flirts with the 200-day SMA near 1.1880, looks to FOMC

- EUR/USD extends the upside to the vicinity of 1.1900.

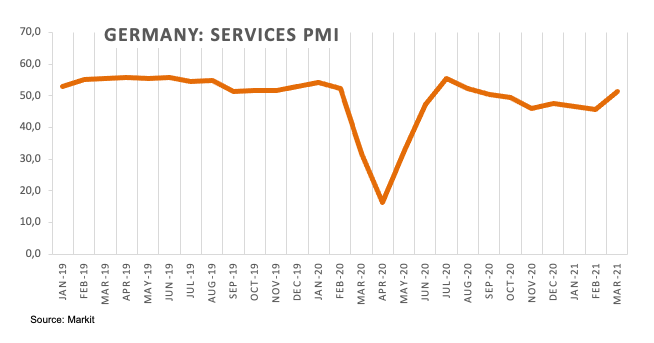

- German Services PMI came in at 51.5 in March.

- FOMC Minutes will be the salient event later on Wednesday.

The single currency keeps the bid tone unchanged so far this week and pushes EUR/USD to the area of fresh tops in the 1.1885/90 band on Wednesday.

EUR/USD looks to dollar, FOMC

EUR/USD advances for the third consecutive and manages to retake the area below the 1.19 hurdle, where sits the critical 200-day SMA.

The persistent and renewed offered bias around the dollar sparked the ongoing corrective upside in the pair from YTD lows in the 1.1700 neighbourhood recorded on March 31. Lower US yields coupled with a better mood in the risk complex, in the meantime, collaborate with the upbeat mood around spot.

In the euro docket, final March Services PMI in Germany and the broader Euroland surpassed the preliminary prints at 51.5 and 49.6, respectively.

Data wise across the pond include MBA’s Mortgage Applications seconded by February’s Trade Balance figures and the EIA’s report on crude oil inventories, although the main attraction will be the release of the FOMC Minutes. Additionally, FOMC’s C.Evans and T.Barkin are also due to speak.

What to look for around EUR

EUR/USD gradually approaches the key barrier at 1.19 the figure and manages to leave behind part of the recent weakness, including fresh yearly lows near 1.1700. The recovery in the pair emerged pari passu with fresh downbeat sentiment in the dollar, sustained at the same time by the knee-jerk in US yields. However, the poor pace of the vaccine rollout in the Old Continent and the impact on growth prospects remain decent headwinds for a sustainable recovery in the pair in the near-term at least.

Key events in the euro area this week: ECB Accounts (Thursday).

Eminent issues on the back boiler: Asymmetric economic recovery in the region. Sustainability of the pick-up in inflation figures. Progress of the vaccine rollout. Probable political effervescence around the EU Recovery Fund.

EUR/USD levels to watch

At the moment, the index is gaining 0.05% at 1.1879 and faces the next hurdle at 1.1889 (weekly high Apr.7) followed by 1.1989 (weekly high Mar.11) and finally 1.2000 (psychological level). On the downside, a breach of 1.1704 (2021 low Mar.31) would target 1.1602 (monthly low Nov.4) en route to 1.1573 (2008-2021 support line).