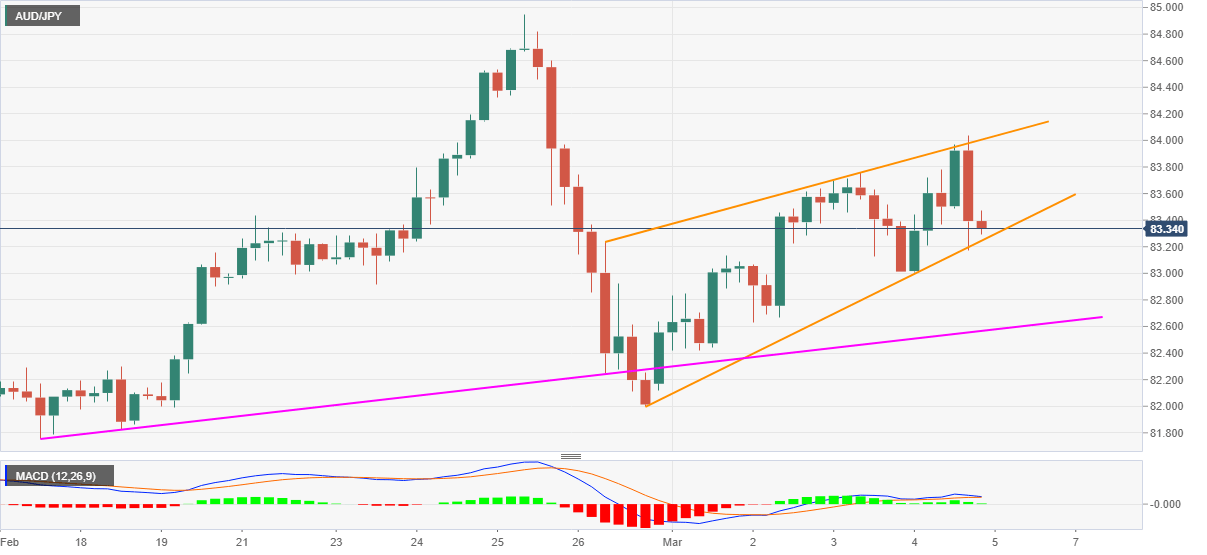

AUD/JPY Price Analysis: Eyes to confirm rising wedge on 4H

- AUD/JPY remains pressured inside bearish chart pattern.

- Downbeat MACD conditions, challenges to risks favor sellers.

- Two-week-old support line adds filters to the downside.

AUD/JPY wavers around 83.40 during the early Asian session on Friday. In doing so, the quote remains on the back foot inside a rising wedge bearish formation on the four-hour (4H) chart.

Given the sluggish MACD and the latest risk-off mood, mainly backed by the surge in the Treasury yields, AUD/JPY is vulnerable to confirm the chart pattern suggesting further downside.

However, sellers will wait for a clear break below 83.25 to keep the bearish view. Also acting as a challenge to the south-run is an ascending trend line from February 17, at 82.55 now.

In a case where AUD/JPY bears dominate past-82.55, the early February tops near 81.20 will be on their radars.

Meanwhile, the 84.00 threshold acts as an immediate upside barrier for the quote ahead of February’s top, also the highest since early 2018, near 84.95.

Should the AUD/JPY bulls manage to cross 84.95, the 85.00 round-figure holds the key to the quote’s further rise towards February 13, 2018 peak surrounding 85.60.

AUD/JPY four-hour chart

Trend: Further weakness expected