USD/INR Price News: Indian rupee snaps three-day downtrend, eyes 73.00

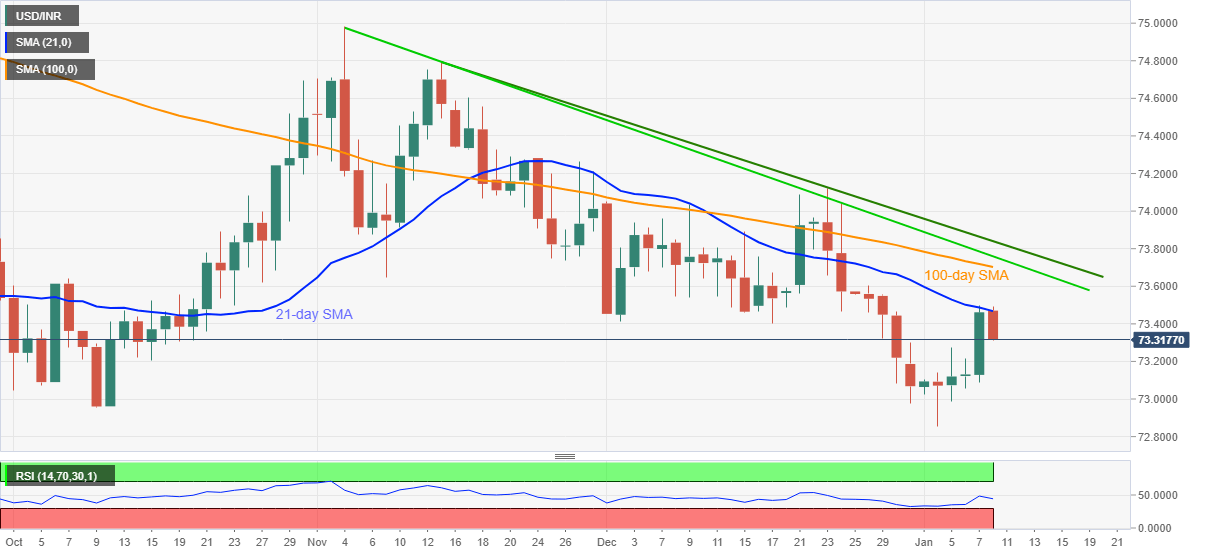

- USD/INR stands on a slippery ground after stepping back from 21-day SMA.

- Downward sloping trend line from November, 100-day SMA add to the upside filters

USD/INR drops to the intraday low of 73.31, down 0.16% on a day, declining for the first time in last four days, while heading into Friday’s European session. In doing so, the quote reverses from 21-day SMA amid normal RSI conditions, which in turn suggests further losses on the card.

Although 73.20 becomes imminent support, the 73.00 and October 2020 low near 72.95 becomes the key levels to watch during the pair’s further downside.

In a case where USD/INR bears dominate past-72.95, the yearly low around 72.85 and the September 2020 bottom near 72.76 will be the key to follow.

Meanwhile, an upside clearance of 21-day SMA level of 73.47 isn’t a green signal for the USD/INR bull’s entry as 100-day SMA near 73.70 will precede downward sloping trend lines from November, respectively around 73.75 and 73.85 to challenge the further advances.

Also, the 74.00 round-figure and the previous month’s peak surrounding 74.15 are additional resistance that challenges the USD/INR bulls.

USD/INR daily chart

Trend: Further weakness expected