USD/CNY Price Analysis: Extends bounce off June 2018 low on downbeat China CPI

- USD/CNY refreshes intraday high as China CPI shrank for the first time since October 2009.

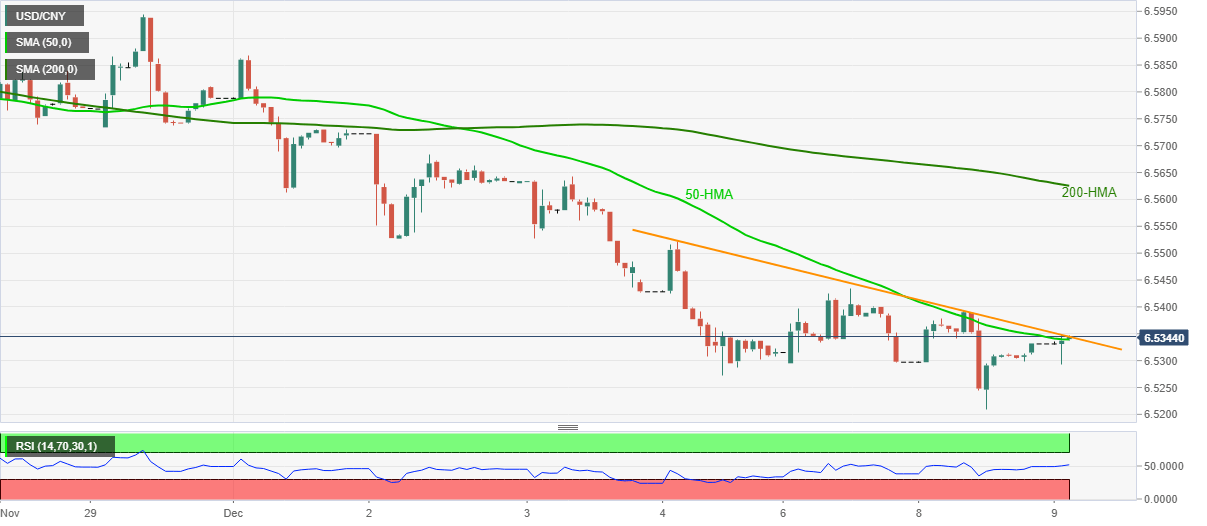

- 50-HMA, weekly resistance line probe buyers, sellers await fresh multi-month low for entries.

USD/CNY seesaws around intraday high of 6.5346, currently near 6.5335, during early Wednesday. The pair jumped to refresh the day’s peak after China’s November month Consumer Price Index (CPI) and Producer Price Index (PPI) data.

While CPI turned negative for the first time since late-2009, PPI recovered from a -1.8% forecast to -1.5% YoY.

Read: China's November Consumer Price Index weaker at -0.5%, first decline since Oct 2009

Even so, the pair needs to cross a confluence of 50-HMA and a falling trend line from Friday, near 6.5340/50, to convince buyers to attack last Wednesday’s low near 6.5530. Also acting as an upside barrier is the 200-HMA level of 6.5627.

Alternatively, the 6.5300 threshold and the recent low, also the lowest since June 25, 2018, around 6.5210, will entertain the sellers during fresh downside.

In a case where the USD/CNY bears dominate past-6.5210, the early January 2018 low near 6.4750 may gain the market’s attention.

USD/CNY hourly chart

Trend: Bearish