Back

30 Oct 2020

Crude Oil Futures: Further retracements appear unlikely

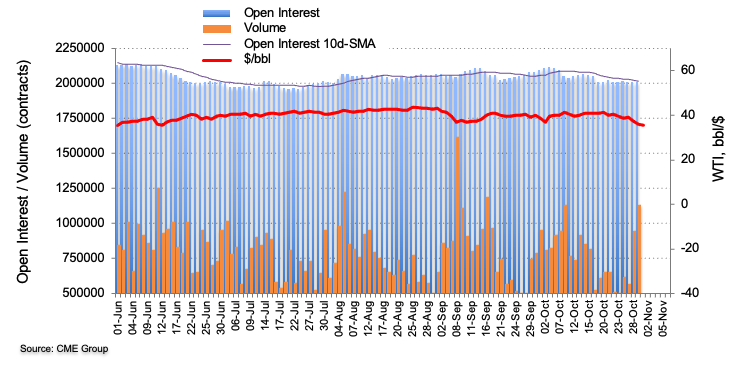

CME Group’s flash data for Crude Oil futures markets noted open interest went down by almost 1.1K contracts on Thursday, prolonging the erratic activity seen in past sessions. Volume, on the other hand, rose for the second session in a row, now by around 187.9K contracts.

WTI seems contained around $35.00

Heightened demand concerns dragged prices of the WTI to the $35.00 zone, or 4-month lows, on Thursday, where some decent contention turned up for the time being. This negative price action was accompanied by diminishing open interest, signalling that a deeper pullback is not favoured in the very near-term.