Gold Price Analysis: XAU/USD still eyes $1849 amid covid, election jitters – Confluence Detector

Growing fears over the second-wave of the coronavirus globally combined with pre-US election jitters will continue to underpin the haven demand for the US dollar, keeping the bearish bias intact in gold (XAU/USD) going forward.

Gold is set to test the September low of $1849, having breached the critical 100-DMA earlier this week. US fiscal stimulus package remains elusive and offsets the optimism over the record US Q3 GDP rebound, as all eyes shift towards next week’s Presidential election.

See Gold Price Analysis: XAU/USD has three ways go in response to the 2020 Presidential Elections

How is gold positioned on the charts?

Gold: Key resistances and supports

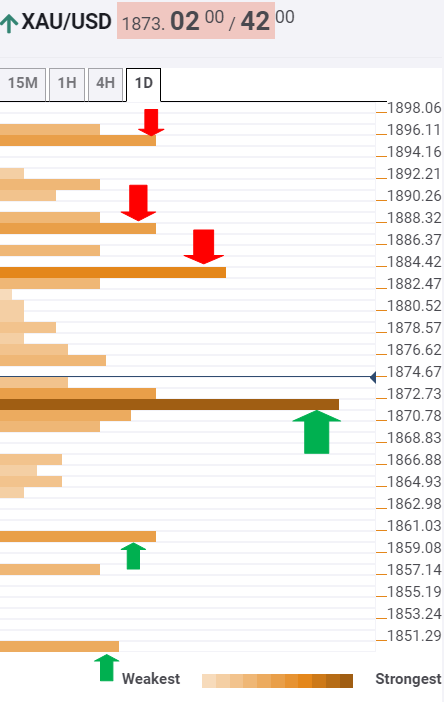

The Technical Confluences Indicator shows that the yellow metal has managed to recapture powerful resistance at $1872, which is the confluence of the SMA5 four-hour and Fibonacci 161.8% one-week.

The next relevant upside barrier awaits at $1883, where the Fibonacci 23.6% one-month lies.

Further up, the pivot point one-week S1 is placed at $1887, which could challenge the recovery towards the previous week low of $1895.

Alternatively, strong support is aligned at $1860, the convergence of the previous day low and Bollinger Band four-hour Lower.

A firm break below the latter could intensify the downside pressure, opening floors for a test of $1850/49 levels. At the point, the pivot point one-week S3 coincides with the September month low.

Here is how it looks on the tool

About Confluence Detector

The Confluence Detector finds exciting opportunities using Technical Confluences. The TC is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. Knowing where these congestion points are located is very useful for the trader, and can be used as a basis for different strategies.

Learn more about Technical Confluence