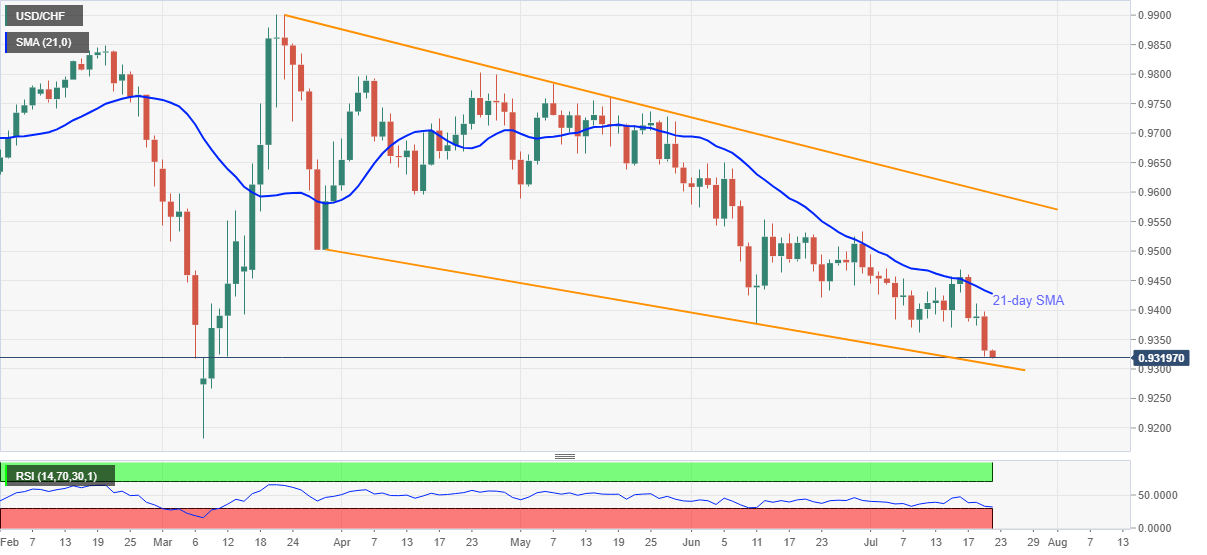

USD/CHF Price Analysis: Sellers attack 0.9300 near four-month bottom

- USD/CHF trades southwards near the lowest since March 10.

- Oversold RSI can trigger the pair’s bounce off a descending trend line from March 30.

- Bulls may refrain entries, even for short-term, unless witnessing a daily close past-21-day SMA.

USD/CHF stays offered around 0.9320, down 0.12% on a day, while heading into the European markets’ open on Wednesday. The quote refreshes the multi-day low following its U-turn from 21-day SMA.

Although bears have all the reasons to recall sub-0.9300 area back to the chart, oversold RSI suggests the pair’s corrective recoveries from 0.9305 mark comprising a four-month-old support line.

In a case where the aforementioned trend line fails to defend 0.9300, 0.9265 and the yearly bottom around 0.9180/85 could lure the sellers.

Meanwhile, a 21-day SMA level of 0.9427 acts as the immediate key resistance for the pair traders to watch as a break of which could trigger short-term recoveries targeting 0.9500 threshold.

Should there be a clear rise past-0.9500 round-figures, 0.9555/50 can act as a buffer before fueling the quote to a falling trend line from March 23, at 0.9600 now.

USD/CHF daily chart

Trend: Bearish