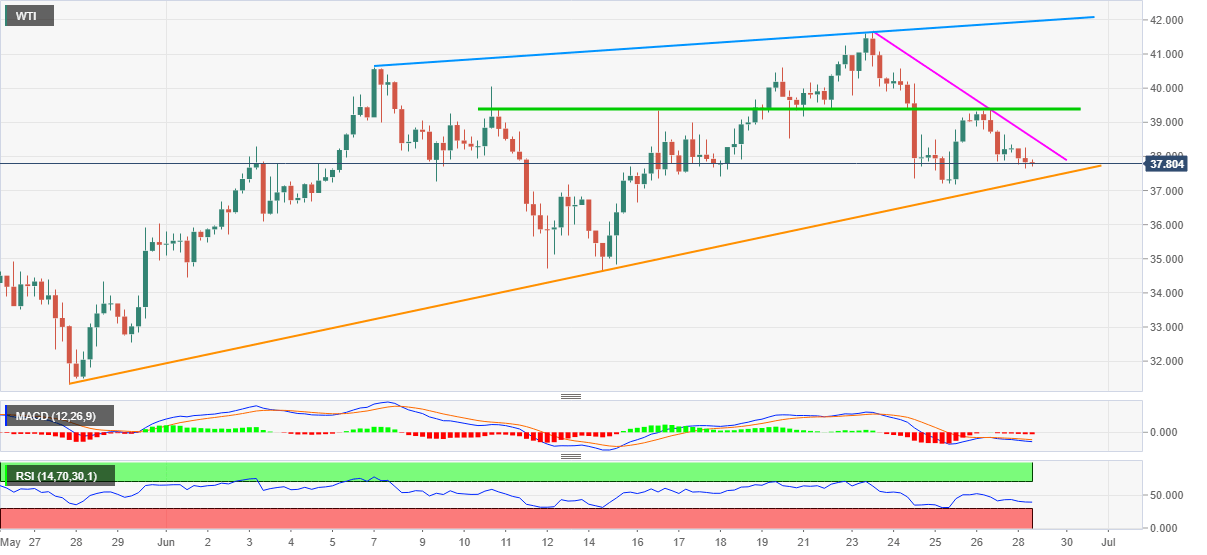

WTI Price Analysis: Drops 1.0% in Asia, $37.30 on bears’ radars

- WTI keeps losses from $39.40 to test the monthly support line.

- Bearish MACD, downward sloping RSI favor immediate weakness.

- The weekly resistance line offers immediate upside barrier before the $40.00 threshold.

WTI stays on the back foot while taking rounds to $37.85, down 1.0%, while heading into the European session on Monday. The black gold’s latest weakness triggered by its failure to cross a short-term horizontal resistance stretched from June 10. Also supporting the bears are downbeat signals from MACD and the RSI conditions.

Hence, further selling by the energy benchmark can’t be ruled out. However, an ascending trend line from May 27, at $37.30 now, may offer immediate support to the oil prices.

Other than the said support line, the mid-month low around $34.60 might also entertain the bears during the further weakness before putting the monthly low of $34.45 in the spotlight.

Meanwhile, an immediate falling trend line near $38.60 guards the energy bench mark’s near-term recovery moves, a break of which could again shift market focus onto the said horizontal resistance near $39.40 and $40.00 round-figures.

During the quote’s additional rise past-$40.00, an upward sloping trend line from June 07, around $42.00, could become the bulls’ favorite.

WTI four-hour chart

Trend: Further weakness expected