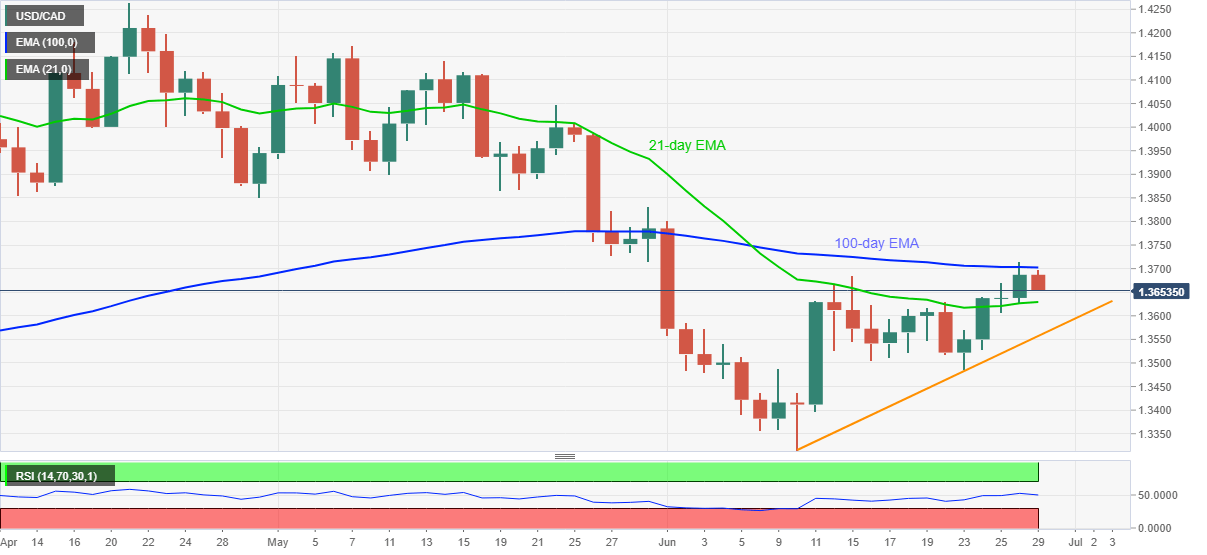

USD/CAD Price Analysis: Reverses from 100-day EMA to stay below 1.3700

- USD/CAD defies a four-day winning streak while easing from 1.3700.

- 21-day EMA, a 13-day-old support line on the bear’s radars.

- Bulls will have to cross May 29 top, April month bottom to justify the momentum strength.

USD/CAD declines to 1.3660, down 0.20% on a day, during the Asian session on Monday. In doing so, the loonie pair justifies the early day’s U-turn from 100-day EMA. As a result, sellers may keep eyes on 21-day EMA as immediate support during the further fall.

Other than the 1.3630 support, comprising the short-term EMA, an ascending trend line from June 10, currently around 1.3560, could also lure the bears in a case of additional weakness.

If at all the bears keep the helm past-1.3560, June 09 high near 1.3488 and the monthly bottom close to 1.3315 might return to the charts.

On the upside, a successful rise beyond the 100-day EMA level of 1.3700 will propel the quote towards May 29 high around 1.3830.

Though, April month low near 1.3930 and 1.4000 psychological magnet might question the bulls afterward.

USD/CAD daily chart

Trend: Pullback expected