When are the UK retail sales and how could they affect GBP/USD?

UK Retail Sales Overview

The UK Retail Sales, scheduled to be published at 06:00 GMT on Friday, is expected to recover from -18.1% prior slump to +5.7% MoM in May. Total retail sales are still seen depleting 17.1% over the year in the reported month, though up from -22.6% booked previously.

Meanwhile, core retail sales, stripping the basket off motor fuel sales, are also likely to trim the coronavirus (COVID-19) impact with +4.5% MoM and -14.4% YoY numbers.

Deviation impact on GBP/USD

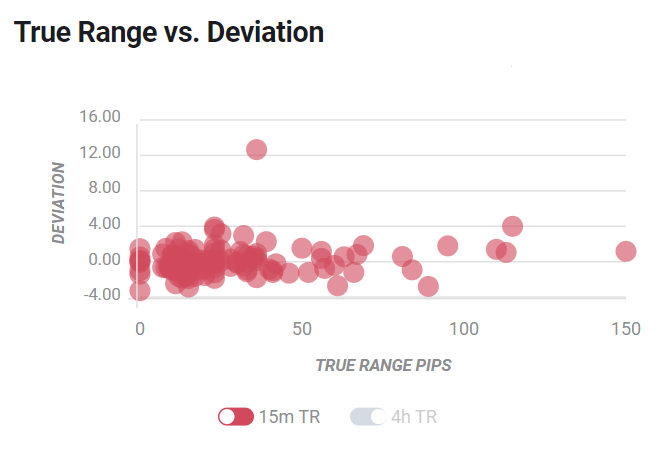

Readers can find FX Street's proprietary deviation impact map of the event below. As observed the reaction is likely to remain confined between 10 and 80 pips in deviations up to 3.5 to -1.5, although in some cases, if notable enough, can fuel movements of up to 150 pips.

How could it affect GBP/USD?

With the latest downbeat data already played roles in pushing the BOE towards additional Quantitative Easing (QE), today’s UK Retail Sales might offer fewer negatives for the GBP/USD pair, unless being drastically down. On the contrary, the BOE policymaker’s refrain to favor negative interest rates might be recalled to trigger the pair’s U-turn in case of upbeat readings.

TD Securities site slow pace of economic restart in the UK to anticipate weaker Retail Sales bounce than the US, “We look for headline retail sales to post a 9.0% m/m gain in May (market expects 6.3%), recouping only part of the -18.1% decline in April. The biggest driver is likely to be fuel consumption, as driving activity picked up quite substantially from the lows in April, while other sectors may post some modest rebounds via online sales. We don't look for as large of a bounce though as the nearly 18% m/m gain in the US, as the UK has generally been slower to exit lockdown, so will likely have to wait until June before seeing a bigger rebound. Our forecast would still leave total retail sales nearly 15% below their January level.”

Technically, the Cable recovers from 14-day low to 1.2432, up 0.06% on a day, while heading into the London open on Friday. In doing so, the quote snaps the previous three-day losing streak to regain 50-day SMA. However, buyers are waitng for a clear break above three-month-old support-turned-resistance, at 1.2465 now, to question 61.8% Fibonacci retracement level of March month downside around 1.2515. On the contrary, the quote’s downside past-1.2400 can aim to refresh the monthly low around 1.2330/25.

Key notes

GBP/USD Price Analysis: Bears attack 14-day low after breaking three-month-old support line, 50-day SMA

GBP/USD Forecast: Pressure mounts, 1.2300 in sight

About the UK Retail Sales

The retail sales released by the Office for National Statistics (ONS) measures the total receipts of retail stores. Monthly percent changes reflect the rate of changes in such sales. Changes in Retail Sales are widely followed as an indicator of consumer spending. Generally speaking, a high reading is seen as positive, or bullish for the GBP, while a low reading is seen as negative or bearish.