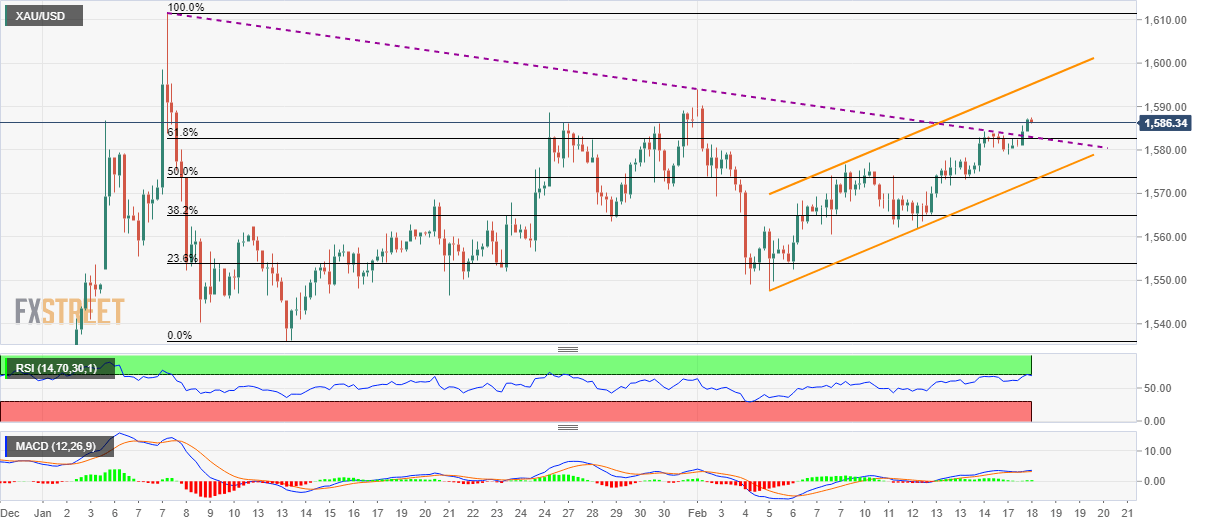

Gold Price Analysis: Positive beyond six-week-old falling trendline

- Gold takes the bids inside a two-week-old rising trend channel, crosses 61.8% Fibonacci retracement of January month declines.

- The channel’s support, 50% Fibonacci retracement restrict the short-term downside.

- Early-month top on the buyer’s radar.

Gold prices take the bids to $1,586.50, +0.35%, during the pre-European session on Tuesday. The yellow metal recently broke a downward sloping trend line stretched from January 08. Though, the resistance line of the short-term ascending trend channel and the monthly top could restrict the bullion’s further upside.

Should there be a further upside beyond $1,594/95 region, $1,600 could offer an intermediate halt to the run-up towards the yearly top surrounding $1,612.

Meanwhile, the precious metal’s declines below resistance-turn-support and 61.8% Fibonacci retracement, at $1,582, could fetch the quote towards another key support confluence. The same includes the said channel’s lower line and 50% Fibonacci retracement around $1,573/72.

In a case where the bears keep dominating past-$1,572, the return of the $1,545 and the yearly bottom close to $1,536 can’t be ruled out.

Gold four-hour chart

Trend: Bullish