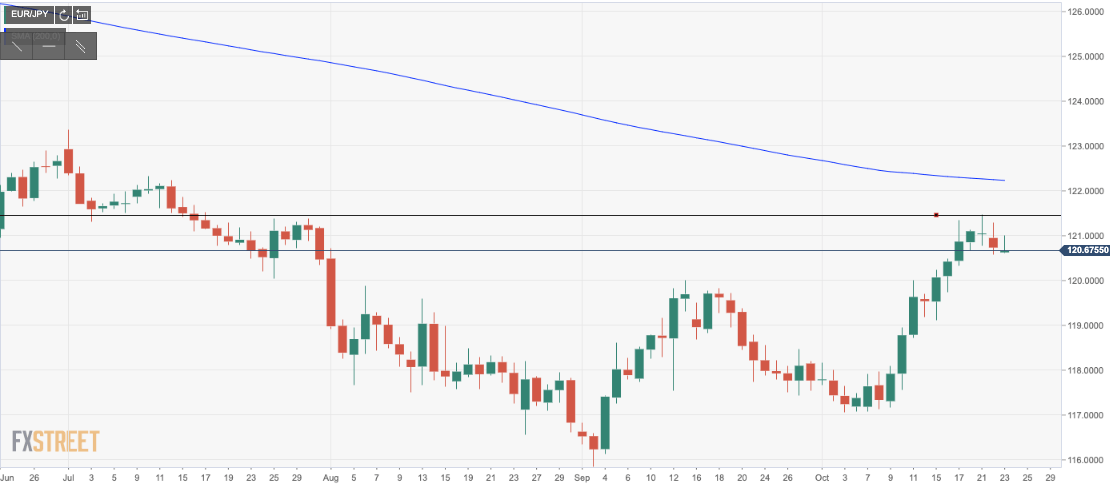

EUR/JPY technical analysis: A series of bearish wicks paints a bearish bias on the daily chart

- EUR/JPY bulls capped ahead of 122 handle and 200-DMA on the horizon

- Bears to run into stronger bids in 119.40/118.80 territories.

The cross has been unable to sustain a bid beyond the 121 handle and a series of bearish wicks paints a bearish bias on the daily chart. EUR/JPY, however, is holding in the 120s ahead of a key support being the 13th Sep highs at 120.01. However, after completing nine consecutive days of higher closing lows, something had to give and a period of consolidation is on the cards at this juncture.

Indeed, the 200-day moving average of 122.25 is a likely target area for the bulls, but 121.50 has to give first with a confluence of the 121.34/ 50% Fibonacci retracement – "This is also the location of the 2018-2019 downtrend, the top of a near term channel and the 121.38 late July high - the break has been minor and we look for it to continue hold the topside," analysts at Commerzbank explained, adding, "Dips lower will find support at the 55 day ma at 118.84/44, ahead of the 117.65 uptrend."

EUR/JPY daily chart