USD/CNH technical analysis: Sellers await rising wedge confirmation after China data

- USD/CNH pulls back after China’s Caixin Manufacturing PMI surged to a five-month high.

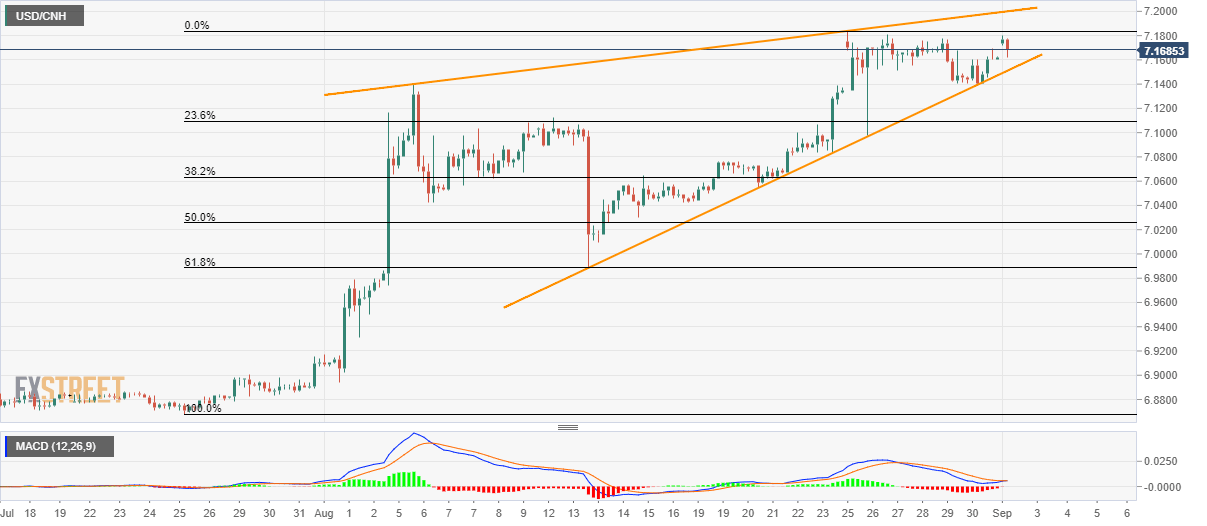

- A downside break of 7.1510 will confirm short-term bearish formation.

With China’s August month Caixin Manufacturing purchasing managers’ index (PMI) surging to a five-month high of 50.4, also beating 49.8 forecast, USD/CNH declines to 7.1685 amid initial Asian trading on Monday.

Sellers await entry on the break of three-week-old rising support-line, at 7.1510, in order to confirm the bearish formation indicating further downside to 7.0000 round-figure. However, 38.2% Fibonacci retracement level of late-July to August upswing, at 7.0632 may offer an intermediate halt during the downpour.

In a case where prices keep trailing 7.0632, 61.8% Fibonacci retracement of 6.9887 and 6.9150 can please bears.

On the upside, the latest high of 7.1838 and formation resistance close to 7.2000 will keep exerting downside pressure on prices.

USD/CNH 4-hour chart

Trend: pullback expected