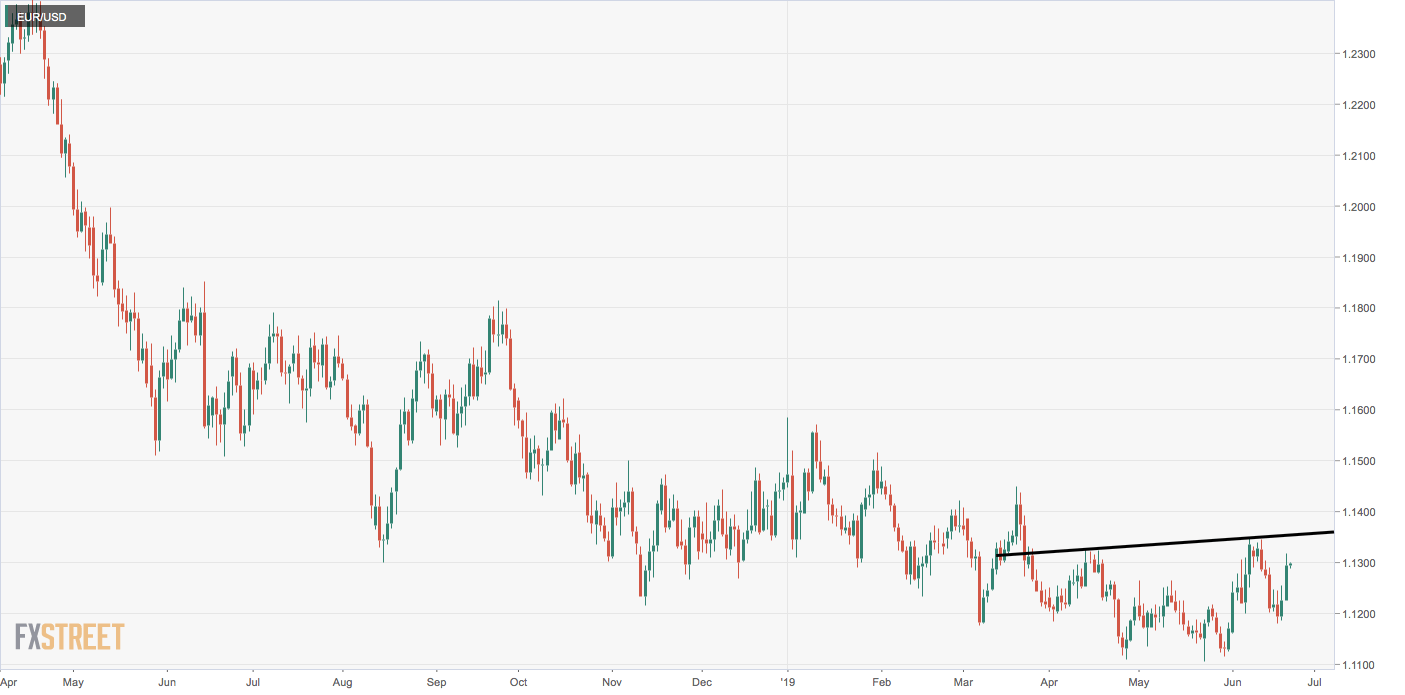

EUR/USD: Charting bullish pattern ahead of German and Eurozone PMIs

- EUR/USD is charting an inverse head-and-shoulders pattern.

- A close above 1.1354 is needed to confirm breakout.

- Bullish breakout will likely remain elusive German preliminary PMIs print below estimates.

EUR/USD seems to be charting a bullish reversal technical pattern ahead of key German and Eurozone data releases, which could influence European Central Bank (ECB) rate cut expectations.

On the daily chart, the pair is creating what appears to be the right shoulder of an inverse head-and-shoulders pattern. The neckline resistance is currently located at 1.1354.

A daily close above that level would confirm the transition from bearish lower highs, lower lows to bullish higher lows, higher highs (bullish reversal) and open the doors to 1.16 – target as per the measured move method).

Dovish Federal Reserve expectations have reached fever pitch and the American dollar is being offered across the board with gold rallying to six year highs above $1,400. So, an inverse head-and-shoulders breakout looks likely.

That said, it is worth noting that markets have pulled forward expectations of a 10 basis point ECB rate cut to December 2019 from March 2020 seen last week. Further, markets are now pricing 15 basis point rate cut by June 2020.

The focus would shft to dovish ECB expectations if the preliminary German and Eurozone PMI for June, scheduled for release later today, show continued deterioration in both manufacturing and service sector activity.

Put simply, the inverse head-and-shoulders breakout will likely remain elusive if the German and Eurozone PMIs print below estimates.

The pair, however, could rise above 1.1354 by NY close if German PMIs indices beat estimates by big margin and the US Markit Manufacturing PMI (Jun) prints below expectations, further reinforcing dovish Federal Reserve expectations.

As of writing, the EUR/USD pair is trading at 1.13, mmeaning the breakout is still 54 pips away.

Pivot levels