US Dollar Index looks for direction near 96.50

- The index struggles for direction in the mid-96.00s.

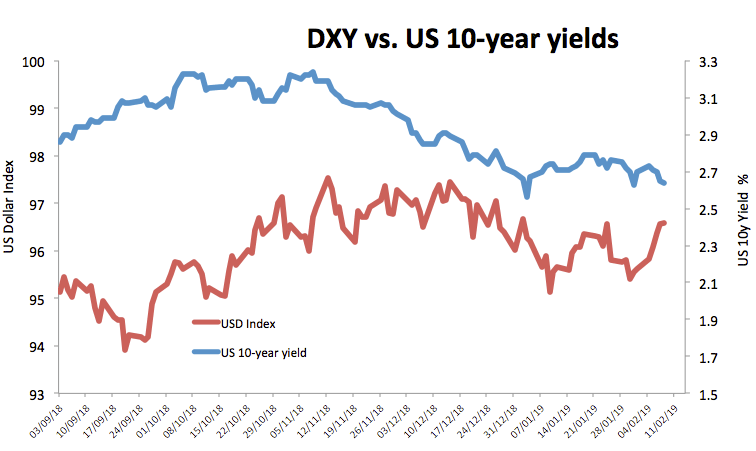

- US 10-year yield come down to as low as 2.64% so far.

- Markets focused on risk trends as docket is empty today.

The US Dollar Index (DXY), which gauges the greenback vs. a basket of its main competitors, is alternating gains with losses in the mid-96.00s against the broader backdrop of consolidative markets.

US Dollar Index focused on risk trends

After briefly testing the area of 3-week peaks near 96.70 on Thursday, the index met some selling mood and is now attempting to consolidate in the 96.50 region within a context of generalized lack of direction in the global assets.

The risk-off sentiment has been prevailing for the most part of the week, pushing yields of the key US 10-year reference lower and at the same time sustaining the safe haven appeal of the buck.

In the meantime, the greenback remains on its way to close the first week with gains after two consecutive pullbacks and is at the same time returning to the upper end of the recent range.

Nothing worth mentioning in the US calendar should leave the bulk of attention to the risk appetite trends so far.

What to look for around USD

Negative developments overseas vs. decent data releases in the US docket have been sustaining the constructive sentiment in the buck for the past sessions and have somewhat relegated concerns over a more ‘flexible’ Fed to the backseat for the time being. In the very near term, investors are looking to the next Trump-Xi Jinping meeting later in the month following some progress in recent trade talks and positive comments from the Trump administration.

US Dollar Index relevant levels

At the moment, the pair is up 0.02% at 96.58 and a breakout of 96.68 (high Jan.24) would target 96.79 (23.6% Fibo of the September-December up move) en route to 96.96 (2019 high Jan.2). On the downside, immediate contention emerges at 96.42 (55-day SMA) followed by 96.22 (38.2% Fibo of the September-December up move) and finally 96.02 (21-day SMA).