EUR/USD parked around 1.1440 following EMU data

- The pair trades within a tight range near 1.1440.

- DXY approaches the 95.80 region, or daily highs.

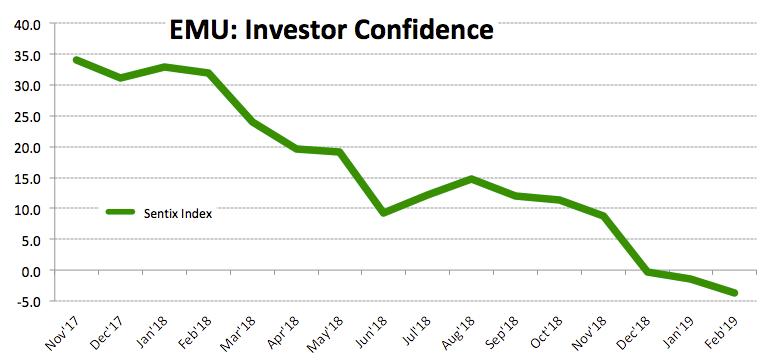

- EMU Sentix index dropped to -3.7 in February.

The mood around the shared currency stays somewhat depressed on Monday, with EUR/USD parked around the 1.1440 area so far.

EUR/USD weaker on EMU data

The pair remains confined to trade within a narrow range today amidst the continuation of the improved tone around the greenback, particularly following Friday’s report on the US labour market and auspicious results from the ISM manufacturing and the U-Mich index.

Earlier in the session, EMU’s Investor Confidence tracked by the Sentix index dropped further to -3.7 for the current month from -1.5 and -1.1 forecasted. Still in Euroland, Producer Prices contracted 0.8% MoM in December and rose 3.0% from a year earlier, both prints missing expectations.

Later in the NA session, November’s Factory Orders will be the only release of note.

What to look for around EUR/USD

The extent and duration of the slowdown in Euroland continues to be in centre stage following recent figures from Q4 GDP, while higher-than-expected advanced CPI figures in January appear to have sparked some optimism among investors. On the political side, the upcoming EU parliamentary elections (May) should start to gather extra interest, always with a close eye on the potential advance of populist views among members.

EUR/USD levels to watch

At the moment, the pair is losing 0.08% at 1.1444 and a break below 1.1425 (21-day SMA) would target 1.1412 (10-day SMA) en route to 1.1406 (low Jan.30). On the other hand, the next hurdle emerges at 1.1514 (high Jan.31) seconded by 1.1515 (50% Fibo of the September-November drop) and finally 1.1569 (2019 high Jan.9).