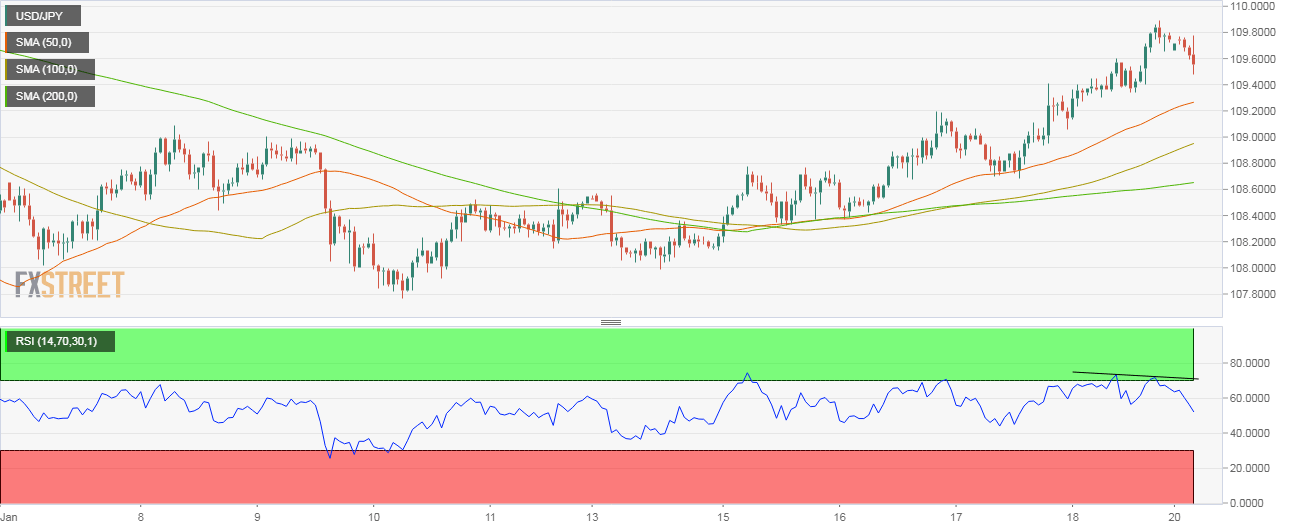

USD/JPY Technical Analysis: Bearish RSI divergence

The USD/JPY pair is currently trading at 109.56 - down 0.18 percent on the day - and could drop further toward the ascending (bullish) 5-day moving average (MA), currently at 109.26, courtesy of the bearish divergence of the 14-hour relative strength index (RSI).

Hourly chart

- The RSI is threatening to drop below 50.00 (in the bearish territory), having charted on Friday a lower high as opposed to a higher high on price.

- The major averages (50, 100 and 200) are trending north and located one above the other, signaling that the path of least resistance is on the higher side.

- The dollar, therefore, could find bids at the ascending 5-day MA of 109.26.

Trend: pullback underway

USD/JPY

Overview:

Today Last Price: 109.56

Today Daily change: -0.19 pips

Today Daily change %: -0.17%

Today Daily Open: 109.75

Trends:

Daily SMA20: 109.25

Daily SMA50: 111.54

Daily SMA100: 112.06

Daily SMA200: 111.19

Levels:

Previous Daily High: 109.9

Previous Daily Low: 109.06

Previous Weekly High: 109.9

Previous Weekly Low: 107.99

Previous Monthly High: 113.83

Previous Monthly Low: 109.55

Daily Fibonacci 38.2%: 109.57

Daily Fibonacci 61.8%: 109.38

Daily Pivot Point S1: 109.24

Daily Pivot Point S2: 108.73

Daily Pivot Point S3: 108.4

Daily Pivot Point R1: 110.08

Daily Pivot Point R2: 110.41

Daily Pivot Point R3: 110.92