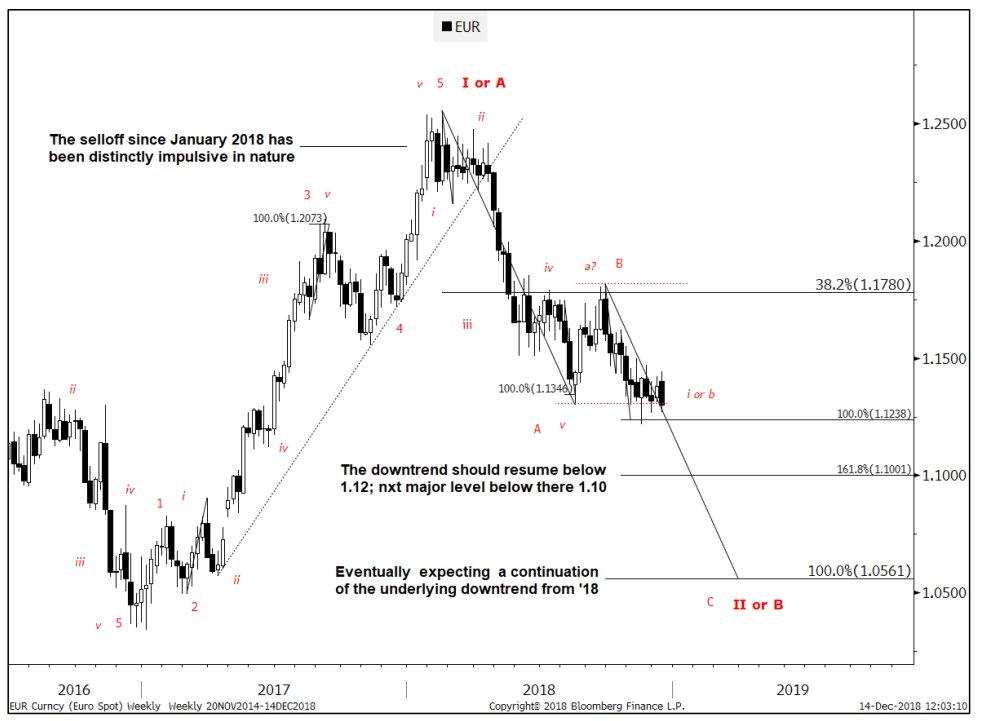

EUR/USD should ultimately retrace to 1.0600 in Q1 2019 – Goldman Sachs

Following the WTI technical outlook by Goldman Sachs published yesterday, the analysts at the US investment banking giant offer Elliot waves (technical) analysis on the EUR/USD pair for the first quarter of 2019.

Key Quotes:

“Question is whether EUR/USD is ready to resume downtrend.

Everything down to the Aug. '18 low was impulsive in nature. From August into year-end, the market entered a corrective phase, one that retraced/has so far held 38.2% at 1.1780.

So far none of what has transpired on the recent decline from September has looked definitively impulsive. It's difficult to chase the trend under these circumstances. For that reason, there's a risk the index sees one more recovery towards the 1.1780-1.18 range highs. That being said, any squeeze of that kind should be viewed within the context of the broader downtrend.

With that in mind, it seems best to either sell the break below 1.12 (range lows) and/or a recovery towards 1.18. Whichever happens first, the target for a C wave from Jan. '18 is still the same at ~1.0561.

Consider eventually adding bearish exposure either from 1.1780-1.18 resistance or below 1.12. Ultimately targeting ~1.056.”