Back

9 Aug 2018

GBP futures: door open for extra downside

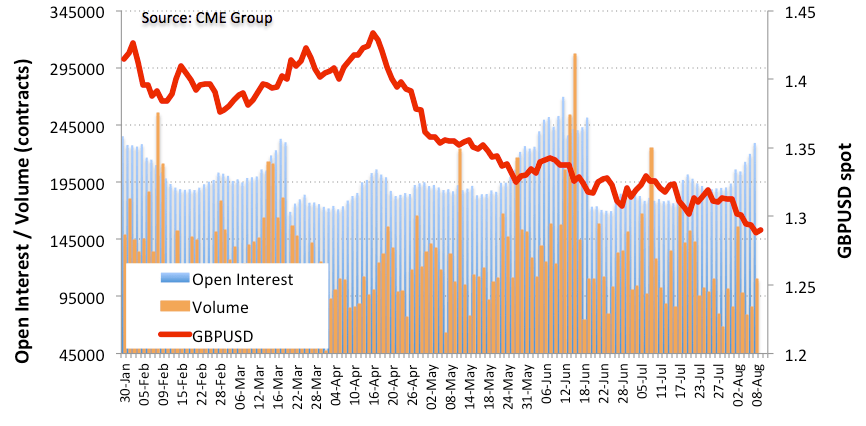

Investors added almost 9.5K contracts to their open interest positions on Wednesday vs. Tuesday’s final 219,746 contracts, according to advanced figures for GBP futures markets from CME Group. In the same line, volume rose by nearly 24.8K contracts.

GBP/USD now looks to 1.2811

The ongoing bearish scenario around the Sterling forced Cable to print fresh 2018 lows in levels last seen around a year ago in the 1.2860 region. The down move yesterday was accompanied by increasing open interest and volume, a bearish sign that leaves intact the possibility of a test of July 2017 low at 1.2811 in the near term.