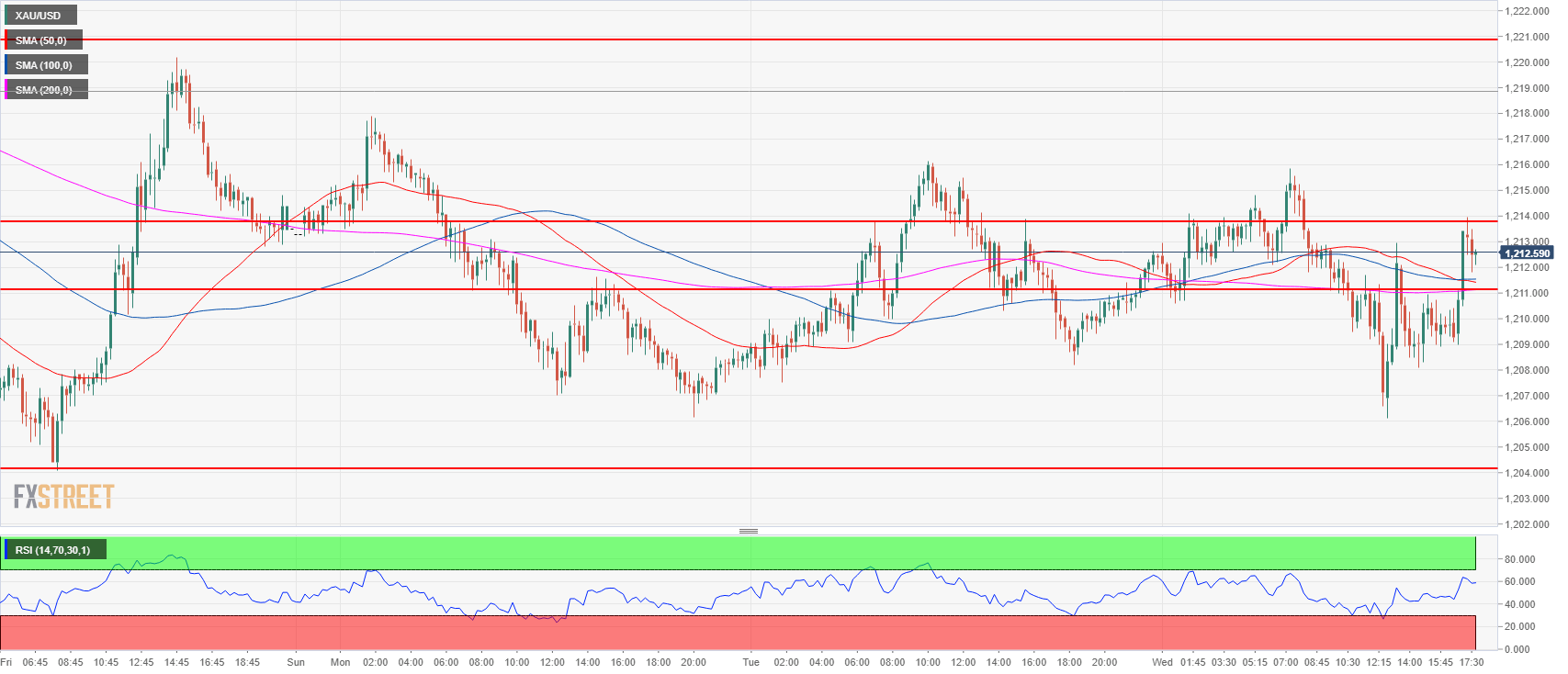

Gold Technical Analysis: Yellow Metal at a crossroad

- Gold is keeping the consolidation theme intact for the fifth day in a row as the yellow metal is debating whether to form a double bottom with July 10, 2017 or to resume the bear trend.

- Gold bears tried to breakout below Tuesday’s low but sellers have been overwhelmed by bulls who brought gold to the 1,213.70 resistance.

- Bears objective is to break below 1,204.10 2018 low to extend the bear trend while bulls want a breakout above 1,236.28 July 13 low, key level in order to create a bullish reversal.

Gold 15-minute chart

Gold daily chart

-636693472139310693.png)

Spot rate: 1,212.79

Relative change: 0.17%

High: 1,215.86

Low: 1,206.10

Trend: Bearish / Double bottom attempt with 1,204.00 July 10, 2017

Resistance 1: 1,213.70 July 31 low

Resistance 2: 1,220.90 July 18 low

Resistance 3: 1,223.00 consolidation area

Resistance 4: 1,225.90 July 17 low

Resistance 5: 1,232.00 consolidation area

Resistance 6: 1,236.28 July 13 low, key level

Resistance 7: 1,241.50 intraday swing low

Resistance 8: 1,245.65 June 28 low

Support 1: 1,211.17 July 19 low

Support 2: 1,204.10 2018 low

Support 3: 1,194.30 March 10, 2017 low

Support 4: 1,180.62 2017 January 27 low