USD/RUB up and down around 57.20 post-CBR decision

- The pair stays sidelined above the 57.00 handle post-CBR.

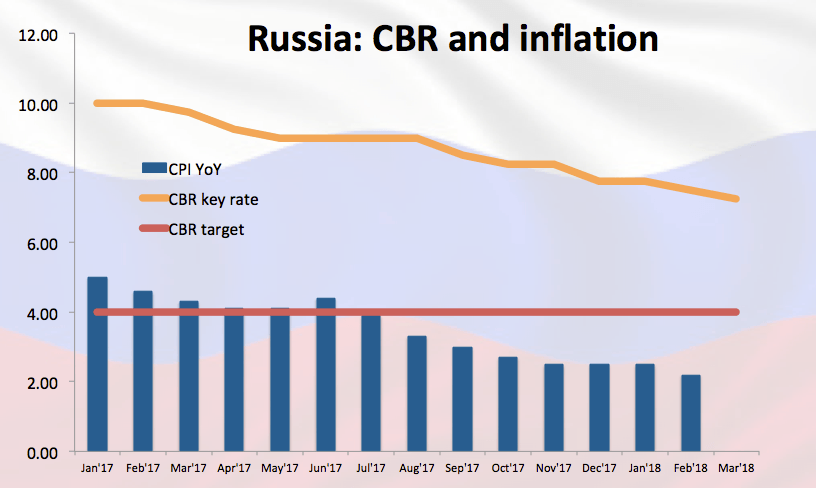

- The Russian central bank (CBR) cut its key rate by 25 bp to 7.25%.

- UK-Russia geopolitical effervescence still in centre stage.

The Russian currency is alternating gains with losses vs. its American counterpart at the end of the week, with USD/RUB hovering just above 57.00 the figure.

USD/RUB unchanged on CBR desicion

RUB remained apathetic after the Russian central bank (CBR) cut its key rate by 25 bp to 7.25% per anum, matching market consensus.

The CBR acknowledged that inflation figures remain low, while inflation expectations are also diminishing progressively. In addition, the central bank expects inflation to ‘gradually return to the target in the second half of the year’ in tandem with a recovery in the domestic demand. Inflation, therefore, is seen at 3-4% in 2018 and closer to the 4% target next year.

The CBR does not rule out further easing of the monetary conditions in order to help domestic demand and lift inflation to the bank’s target.

Regarding the economic activity, the CBR noted the economic growth resumed this year following the poor performance during 2017, and now sees the economy expanding by 1.5%-2% in the 2018-2020 period. The central bank also increased the price for crude oil in its baseline scenario.

In the meantime, spot is testing the 10-day sma in the 57.25 area following yesterday’s strong advance, although the current broad-based weakness around the buck is poised to keep it under pressure.

USD/RUB levels to watch

At the moment the pair is down 0.08% at 57.19 and a break below 56.87 (21-day sma) would expose 56.81 (55-day sma) and then 56.74 (low Mar.22). On the upside, the next hurdle is located at 58.02 (high Mar.19) seconded by 58.16 (200-day sma) and finally 58.75 (2018 high Feb.9).