EUR/JPY: Euro bouncing off the 200-SMA before Jerome Powell speaks

- Bundesbank president Jens Weidmann delivered positive growth outlook for the Eurozone.

- Fed chairman Jerome Powell is scheduled to speak in Congress with his speech made public at 13:30 GMT.

The EUR/JPY is currently trading little changed on the upside at around 131.75 before Powell’s Congressional testimony scheduled for later on Tuesday.

Major currency pairs are trading stagnant trapped in tight ranges before Powell’s speech that is seen as a key risk for the FX market for the day, setting the trend for the longer period of time even with Powell expected to choose his words carefully during his first Congressional testimony.

The set of the ECB policymakers spoke earlier on Tuesday with the ECB executive board member Yves Mersch refraining from comments on the economy and/or monetary policy.

The Bundesbank president Jens Weidmann said that the ECB monetary policy will remain very accommodative even if QE ends with recent strength of Euro unlikely to alter the policy stance. In Weidmann’s view, there are indications that the FX movements is having less impact on inflation compared to the past.

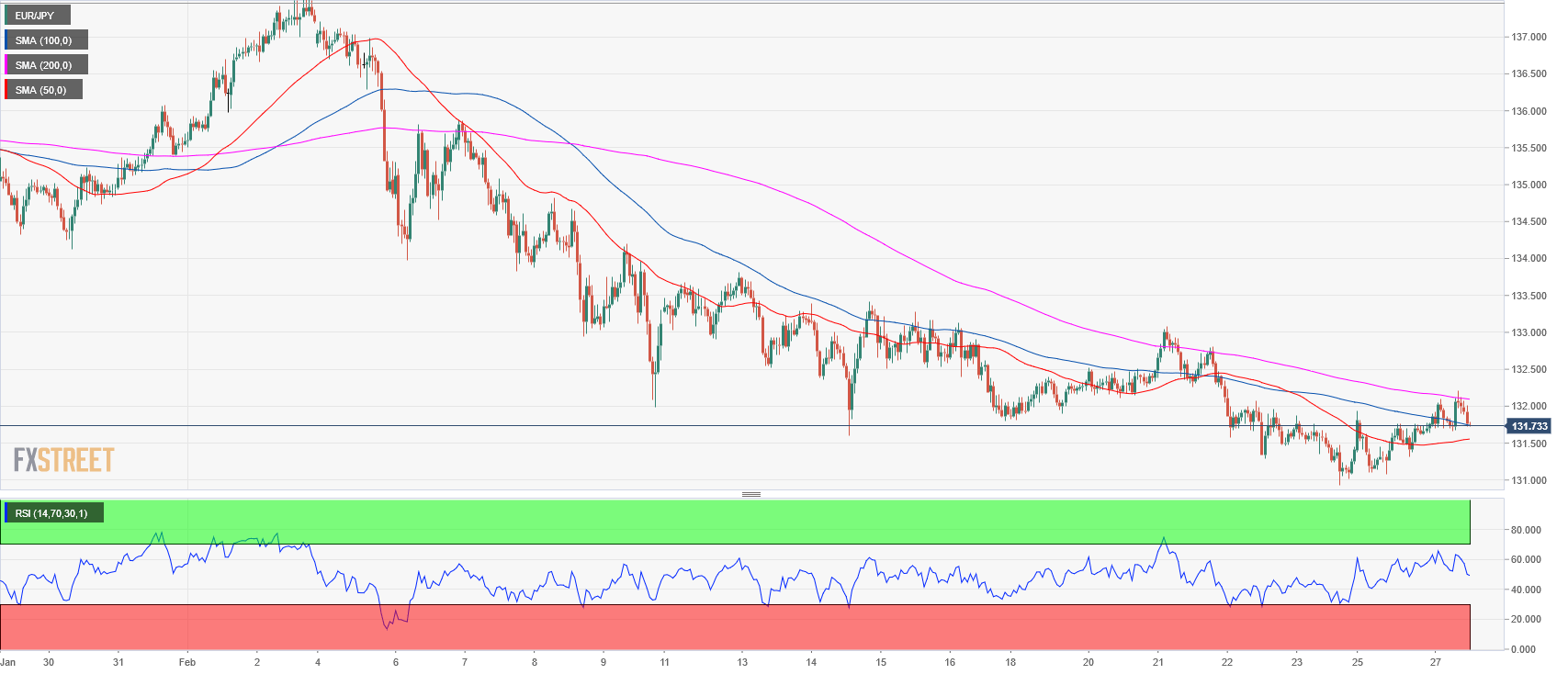

Technically, the EUR/JPY is bouncing off the 200-period moving average on the 1-hour chart. Next resistance is seen at 132.50 psychological level and former congestion zone. Further up, the 133.00 big figure is the next resistance. To the downside, the 131.50 figure in conjunction with the 50-period moving average on the 1-hour chart is the next support. Further down 131.00 big figure and cyclical low is the next key support.

EUR/JPY 1-hour chart