USD/RUB retreats from highs, around $59.60

The Russian currency is trading on a firm fashion vs. its American peer on Monday, taking USD/RUB slightly lower in the 59.60 area.

USD/RUB lower, USD loses momentum

After climbing as high as the 59.70 region in early trade, the pair has now receded a tad as the greenback is also surrendering part of the initial gains while crude oil prices are attempting a bounce.

The barrel of Brent crude is losing smalls around $55.40, trading in a narrow range with the downside limited around $55.20 for the time being.

Data wise in Russia, November’s trade surplus bettered estimates at RUB 9.14 billion vs. RUB 7.6 billion expected and up from October’s RUB 6.6 billion surplus.

In the meantime, trade conditions remain thin today as US markets remain closed in remembrance of MLK holiday.

Looking ahead, geopolitical effervescence, crude oil dynamics and US-Russia scenario under Trunmp’s administration appear to be the main drivers for RUB in the next months.

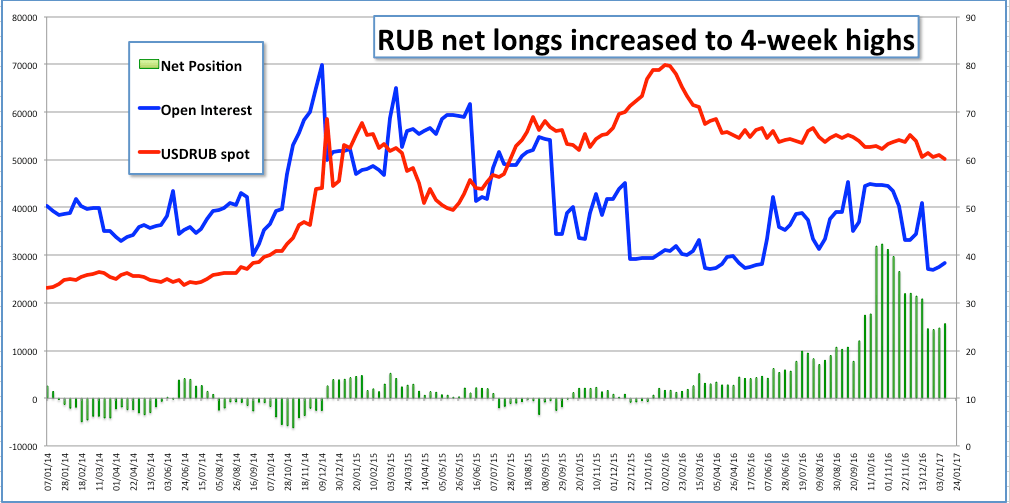

In the meantime, RUB also appears well underpinned by speculative positioning, showing net longs have climbed to 4-week peaks during the week ended on January 10.

USD/RUB levels to watch

At the moment the pair is losing 0.02% at 59.67 facing the immediate support at 59.11 (low Jan.6) followed by 58.57 (low Jul.29 2015) and then 56.20 (low Jul.10 2015). On the upside, a surpass of 60.46 (20-day sma) would open the door to 60.66 (high Jan.11) and finally 61.63 (high Dec.20).