EUR/JPY Price Analysis: Bullish tilted as hammer emerges, back above 159.00

- EUR/JPY up 0.14%, rebounding from weekly low amid weaker Yen and improved risk sentiment.

- Hammer pattern suggests further gains, targeting the 160.00 level for recovery continuation.

- Downside risks with support at Kijun-Sen (158.47) and Senkou Span B (158.41) crucial for momentum.

The EUR/JPY stages a comeback after bouncing off a weekly low of 158.08 and rising back above the 159.00 figure, gaining 0.14% at the time of writing. An improvement in risk appetite, along with sudden Japanese Yen (JPY) weakness, opened the door for the Euro’s (EUR) recovery.

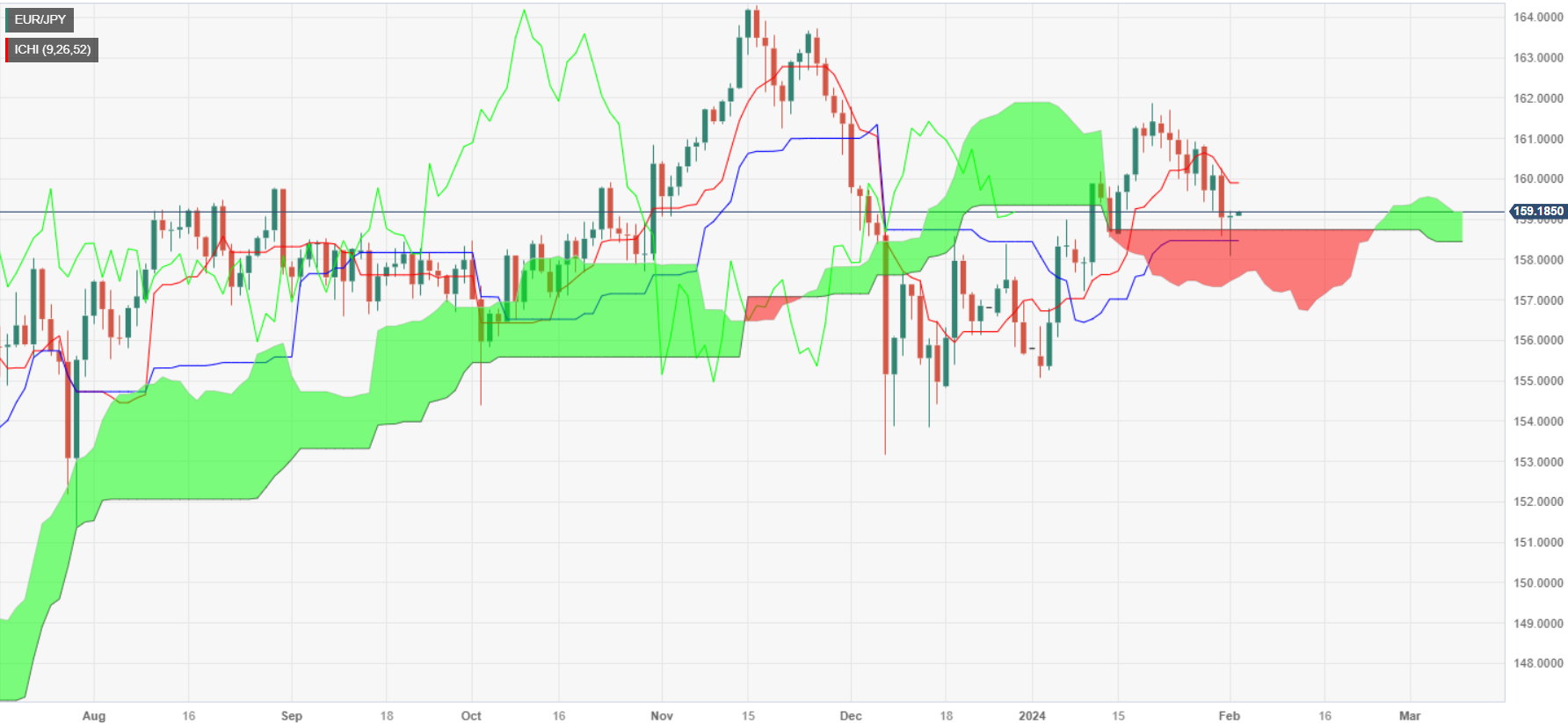

From a technical standpoint, the EUR/JPY is forming a hammer after diving inside the Ichimoku Cloud (Kumo), though buyers lifted the pair above the Senkou Span B at 158.41, opening the door for a rally to 159.00. If buyers reclaim the 160.00 figure, that could open the door to challenge January’s 31 high at 160.27.

On the flip side, if the EUR/JPY achieves a daily close below 159.00, that could pave the way for further downside. The first support would be the Kijun-Sen at 158.47, followed by Senkou Span B at 158.41. A breach of the latter will expose the February 1 low of 158.08.

EUR/JPY Price Action – Daily Chart

EUR/JPY Technical Levels