USD/JPY Price Analysis: Bulls need to guard 132.50

- USD/JPY bulls will need to commit to the daily trendline support.

- 132.50/70 is key support if the thesis for a breakout above 134.00 to go higher can live on as per the weekly chart´s outlook.

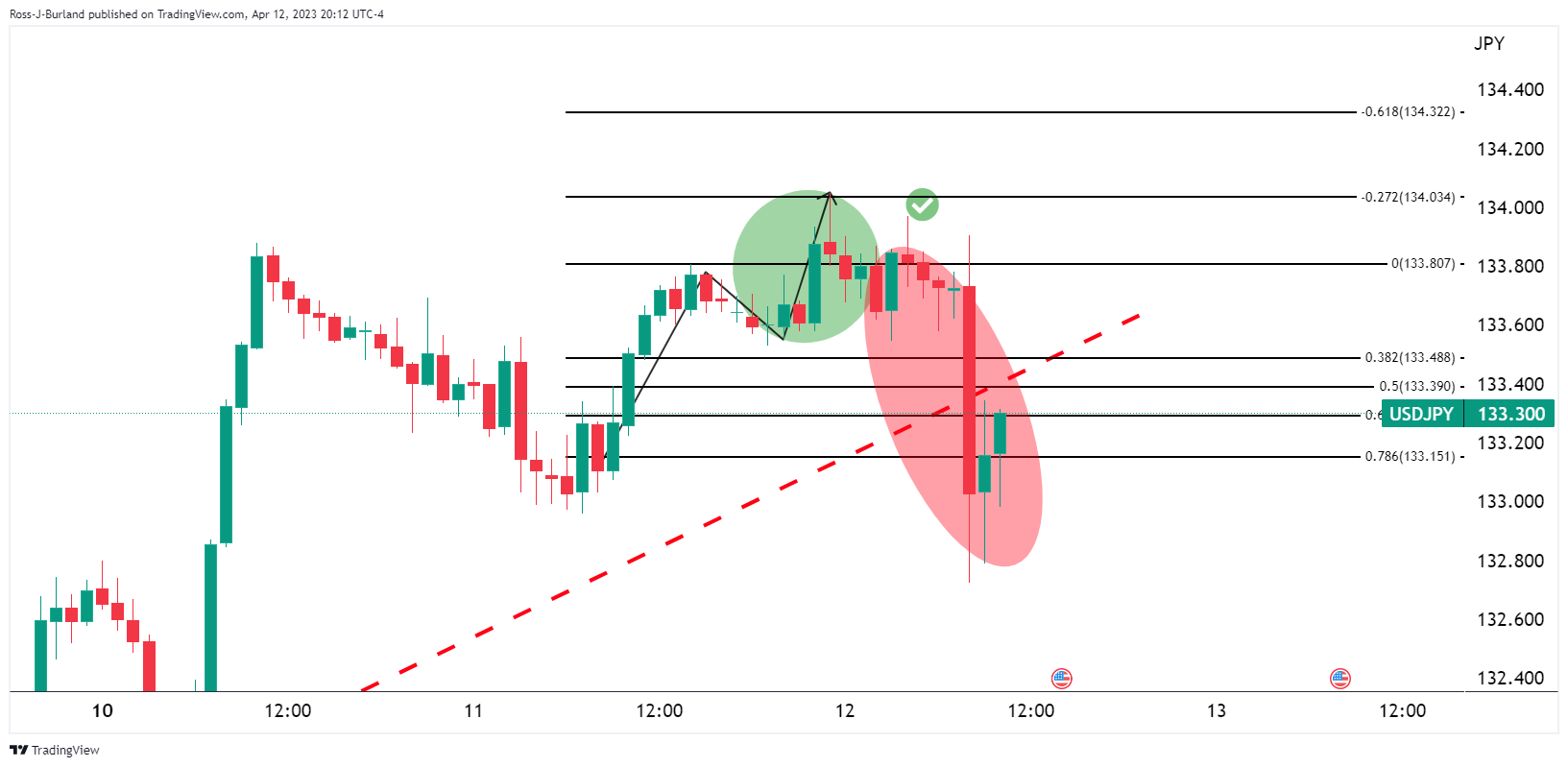

As per the prior analysis, USD/JPY Price Analysis: Bulls eye a run to test 134.00 with eyes on US CPI, when USD/JPY was at 133.60, the price did indeed go on to test 134.00 ahead of the US consumer inflation that was due later in the day.

USD/JPY Prior analysis

The price was meeting a 50% mean reversion and rallying from there:

USD/JPY updates

The objective was met as illustrated above. However, what followed next was a sell-off over the US CPI data:

This is now leaving the price in no-man´s land:

USD/JPY weekly chart, prior analysis

However, reverting back to the original analysis, the bigger picture remains bullish as per the weekly chart. It was stated that The weekly chart is showing that the price found support at a 78.6% Fibonacci retracement level of the prior weekly bullish impulse. This is bullish for the foreseeable future.

USD/JPY daily charts

The bulls will need to commit, however, to the trendline support and preferably to above 132.50/70 for prospects of a breakout above 134.00.